Argued to be “one of the unicorns of macroeconomics”, GDP-linked bonds are a type of state-contingent debt instrument that allows a country to adjust its payments of government bonds according to its economic performance. This means a country will pay more when its GDP is higher, and less when its GDP is lower, thus reducing the risk of default and the need for fiscal austerity, in economically troubling times.

Some economists and policymakers have advocated for the issuance of GDP-linked bonds as a way to prevent solvency crises, especially in the aftermath of the COVID-19 pandemic, which has increased public debt levels around the world. The Bank of England and Bank of Canada published an article stating, “GDP-linked bonds help reduce the likelihood of solvency crises. This is because GDP-linked bonds provide a form of ‘recession insurance’ that reduces principal and interest payments when a country is hit by a negative growth shock. This helps to both stabilise the debt-to-GDP ratio and increase a sovereign’s capacity to borrow at sustainable interest rates.”

However, GDP-linked bonds are not widely used in practice, and the few examples that exist have been issued at very high premiums, reflecting investors’ uncertainty and lack of familiarity with these types of instruments. For example, the premium on GDP-linked bonds Argentina issued as part of its 2005 debt restructuring was estimated to be 1200 basis points (even after taking out default risk).

Therefore, GDP- linked bonds may not be a sole financial instrument to prevent solvency crises but a useful complement to other debt management tools, such as debt restructuring and fiscal rules.

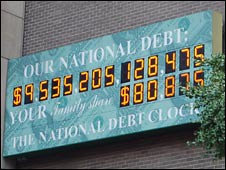

Image: National Debt, Thomas Pauly, 2008 // CC BY-NC-ND 2.0 DEED

Average Rating